Before You Set Your 2026 Money Goals, Do This One Thing First…

Most people jump straight into financial goal setting… and then abandon their money goals by February. If you want to build SMART financial goals that actually stick, you must start with your deeper purpose — your financial ‘why.’ People do not drop their goals because they don’t want to pursue or accomplish them, they are still motivated but perhaps they lack clarity? According to Google AI most people don't stick to their goals, with estimates suggesting only 8% to 10% achieve long-term success, especially with New Year's resolutions, where many quit within weeks, but writing goals down and making them specific, with small, and habitual action steps can significantly boost success rates. They suggest important factors for success involve breaking down these big goals, by tracking small wins, and building repeatable habits, rather than just “dreaming” that the results will appear on their own. I truly believe that if you do not dig into the overarching WHY of your goal, when life and the whirlwind of our days take over you will forget and go back into your other habits.

Why Your Financial “Why” Matters More Than the Goal Itself for Long-Term Money Success

Your “why” matters more than the goal itself because the rationale of this “why” will provide purpose for your continued sacrifice to achieve success and provide the persistence you may need over time. Without an emotional connection, your goal could feel like a chore which means it's abandoned easily and quickly. Your “why” also could keep you anchored when as I mentioned life gets busy, stressful, or unpredictable. 1️⃣ Set aside some time and make sure you really reflect on your purpose and dig into the long lasting accomplishment you want to achieve and why it's important in your life right now.

As you think on the purpose and “why”, let’s take a quick look back at 2025 and provide some context for reflection. This will provide a foundation for your intentional goals - not cookie cutter resolutions. Grab a piece of paper or your electronic note pad and start answering these questions:

What were you most financially proud of this year?

Did something feel hard, or really drain you or stress you out to the max in 2025?

Was there a particular area you felt you grew and succeeded?

Could there have been a money process that you felt misaligned?

Am I committed to a money mindset reset?

What financial habits in 2025 supported your success, and which money patterns held you back?

Define Your Core Financial Values (Your Internal GPS)

David Bach introduced his "Value Circle" as a financial planning tool from his book Smart Couples Finish Rich, where he recommends couples identify their top 5 core life values (like family, freedom, security) to discover their financial "why," using money as a tool to achieve those values, thereby aligning spending with what truly matters and a unified vision. It helps resolve internal conflicts by connecting habits to fundamental beliefs, making saving and investing purposeful rather than a chore. His objective was simple honesty and writing down only what feels right at a gut level. You start with the simple question: What is really important to you?When you think about your life and things that really matter, what value is most important to you? What’s the purpose of money in your life? When you can define your values, these will become your internal GPS for the majority of your financial planning, direction on saving, decision-making and the plus is your goals will feel more meaningful and motivating after this definition. I found this to be an instrumental exercise and encourage you to take some time and start this step by asking yourself: 2️⃣ What matters most to you for 2026, you want to identify those core personal & financial values and once defined you can anchor your goals to these values for emotional alignment. Keep in mind you want between 3 to 5 values and no more as you define your financial planning for the new year.

Examples of financial values.

Now that you have defined your values, we need to dig into your 2026 Money “Why”. 3️⃣Let’s ponder why you want to tackle this initiative this year. A clear purpose acts as a guide, giving direction for your decisions and actions. It can also help you understand what you are truly trying to achieve, which prevents you from drifting off track. Jot down some ideas, but here are some prompts if you aren’t sure where to start:

“Why does this goal matter to me personally?”

“How will my life improve when I reach this goal?”

“Who else benefits when I follow through?”

“What deeper need is this goal connected to—personal peace, debt freedom, financial confidence, household stability?”

Now let’s set your SMART financial goals — goals rooted in your values and built to last all year

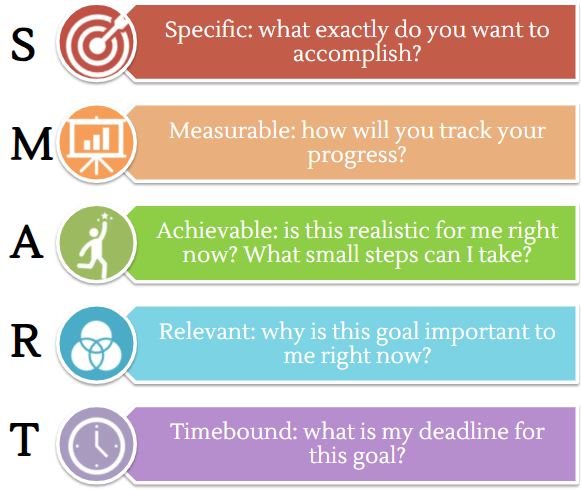

Setting financial goals gives your money a purpose — and gives you a clear direction. Without a goal, it’s easy to feel stuck, overwhelmed, or unsure where to start. But when you define what you want and why it matters, your choices become more intentional, and your progress becomes measurable. 4️⃣ Let’s turn your intentions from above into achievable action using the SMART process. Using the direction below on how to set money goals, start writing out your thoughts for each section and remember: SMART goals without a “why” fall flat — but SMART goals built on your values are powerful.

Directional assistance in defining your own SMART goal.

Now Let’s Create Action Steps That Build Momentum All Year

When you think about the five sections above in the SMART process it is important to remember you most likely cannot accomplish the entire goal in a few weeks, so make sure you are considering options to make small wins along the way. Perhaps you are measuring your progress with weekly money check-ins, you plan to automate your savings, or even to make debt payments bi-weekly compared to monthly. Smaller milestones can help you build these new habit shifts each month and I recommend reviewing your progress quarterly. It’s all about achieving sustainable change, so be sure to create bite size and manageable pieces for yourself. I am a huge believer in visuals as well, so 5️⃣ download my free printable SMART Goal Vision Board [click here]. It is a single page where you can document your new SMART goal, a section to list out 3 action plan steps you can take to achieve your goal plus an area to remind yourself about your financial values. Place this printable in an area of prominence and high visibility as it will provide you not only encouragement but accountability daily as you consider potential sacrifices or a hard road ahead.

2026 does not need a new you - it needs a more aware you. I encourage you to take the time to reflect, reset, and reimagine the 5 steps I have recommended. I know I am better for it and wish the same for each of you. Put in the comments below what goal you are working on for 2026!

In closing, a perspective from Steve Maraboli: “If you have a goal write it down. If you do not write it down, you do not have a goal - you have a wish.”

If you’d like support creating financial goals for 2026 or want help building better money habits, schedule a FREE 45-minute clarity call.

If you have enjoyed this article, follow me on social @lordfinancialcoaching.