What Should Your Food Budget Actually Be? A Simple Guide to Resetting Your Grocery Spending.

Do you often ask yourself “why is my grocery bill so high?” Many families have no idea if their grocery budget is normal, outrageous, or thrifty. If you’ve ever wondered how much you should spend on groceries, you’re not alone. Food spending can vary based on what season of life you're in and the time available for planning, preparing & cooking. But patterns matter as well - are you good at laying out a meal plan and sticking with it or are you overwhelmed after work and just winging it by what is in your fridge or freezer, or do your impulse fast food on your way home from a soccer game? We are going to focus on using real data and mindset shifts to create a grocery spending plan that finally makes sense.

Your grocery budget category can often feel chaotic and difficult to control. Do you have time to plan meals and cook at home? That’s wonderful but let’s remember that the prices of groceries continue to go up. It’s hard to manage this line when your monthly expenses may not be accounting for 5 shopping trips or just 4 - the number of weeks per month varies. There is no judgement here, but busy schedules play a role in last minute decisions and emotional eating after a difficult day; and who does not have decision fatigue every once in a while?

Reset Your Mindset and Use USDA Data to Create a Realistic Grocery Budget

Today we’re using real USDA data to help you create a realistic food budget and finally feel confident about your monthly food spending. The USDA’s Thrifty Food Plan is one of the most reliable ways to estimate a reasonable grocery budget for your household size. The Cost of Food Report includes average grocery spending from American households monthly, and per their website: USDA produces four food plans… Each food plan specifies quantities of foods and beverages that could be purchased and prepared to make healthy meals and snacks at home. Each food plan has an associated cost based on average prices of their respective foods and beverages at the time of publication plus adjustments each month to reflect inflation using the Consumer Price Index for All Urban Consumers (CPI-U). When I learned about this option I thought it could be a good reference point to understand where my family fell in our overall grocery spending - but it is important to consider this data to provide clarity on your spending (not judgement). So often I hear from my clients that they were not sure how they measured up - this is a good perspective to utilize for planning this line item.

How does the USDA create their food plans? The Thrifty Food Plan is built using a mix of nutrition science, food prices, household consumption patterns, and dietary guidelines. It’s not random — it’s a structured, data-driven model. They collect real grocery store prices and model market baskets of foods together to meet nutrition needs for one month using common foods Americans actually buy, that are widely available including affordable, nutritious options across all food groups. These baskets must meet all nutrition standards and assume all meals are prepared at home. They will then update the plan using inflation and economic shifts, so they stay current with real-world grocery trends.

How Can You Use the USDA Thrifty Food Plan to Right-Size Your Grocery Expense Line Item?

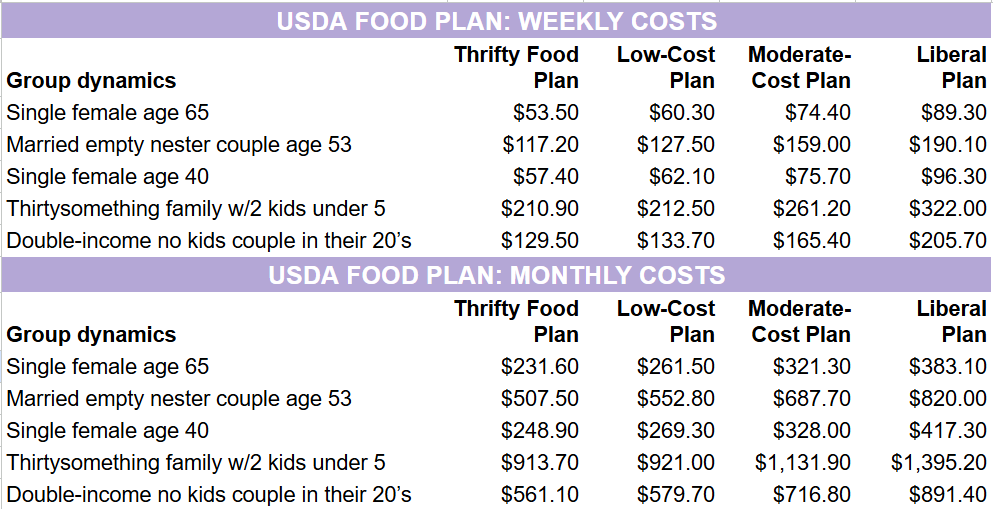

To right-size your monthly grocery budget, start by reviewing your last three months of food-at-home spending. This gives you a real baseline before comparing it to the USDA food plans. Note these numbers should not include any restaurant or eating out costs. The comparison we are exploring is only food spending at the grocery store(s). You should create a separate dining-out budget based on your household habits and schedule. Below are my recommended steps to assess what is your household's range for potential grocery spending, you can view data on a weekly basis or monthly. I recommend noting down both figures:

Look up the latest USDA monthly food cost report on their website [click here].

Find your household composition (i.e. adults by age and sex) as well if you have any children by age group.

Compare your actual spending to the USDA ranges, there are two options to explore. Either “Thrifty Food Plan” or “Other Food Plans” which provides clarity on three levels - Low-Cost, Moderate-Cost and Liberal Plan.

Identify where your grocery line-item falls: under, at, or above those averages. Please note if you are above those averages give yourself grace and don’t panic and immediately cut your budget. This data is an opportunity to assess your spending and provide awareness for clarifying if you want to make changes.

What does your food spending say about you (and your family)? This is the time for you to reflect on whether you are over the average you want, is our family overbuying and wasting food? Could we be better at meal planning to avoid eating out? It’s important to contemplate if your lifestyle or convenience choices are driving the costs in your household grocery spending.

Reimagine Your Monthly Food Budget: How to Set a 2026 Grocery Plan That Works

Once you understand your grocery patterns, you can create a 2026 grocery budget that feels sustainable — not restrictive. So, take the data you have collected, and consider using these four actions next year:

1️⃣ Set a realistic weekly (or monthly) grocery target. Based on your lifestyle and the USDA comparisons, figure out your new grocery expense line-item amounts. I recommend you do an annual spending plan [click here for my free tracker] and plan the number of shopping weeks each month, don’t just assume each month you will spend the same amount. For example, if you shop every Saturday for the 2026 calendar year there are a few months that have 5 shopping days. If you only plan for 4-weekly shopping trips every month, then for those few months you will overspend and you don’t want that. So, plan accordingly, so you are not shortchanging your spending - but instead planning appropriately. And when you consider this target, ask yourself: Are my grocery spending habits aligned with my financial goals?

2️⃣ Choose a meal strategy that fits your energy level. Do you struggle with reducing your grocery costs because of lifestyle choices or convenience? I get it, not everyone can meal-prep but I do think it’s reasonable to plan with your family or yourself 30 minutes every week to lay out your meals in advance. I found this What To Eat notepad on Amazon that I can keep on my fridge for easy visibility, but you could just use a sheet of paper or download other free templates. I personally bulk cook my breakfasts and lunches on Sunday as it helps me to jam it all out without worry during the week. But you could consider theme nights to make the meal choices simpler or quick-prep kits or even freezer to slow cooker recipes.

3️⃣ Make small changes that reduce overspending. Creating revisions to your normal practice of shopping can have significant impact - but start small so it does not feel like you're giving up too drastically. One small change is we should always shop from our pantry first. This one is hard for me as I always want to jump in and make a recipe I see on Instagram or Facebook, only make the recipe if you’re using pantry items already purchased. Another idea is to check if your local grocery store offers a shopping app, for me using this service and allowing them to shop on my behalf then I just need to visit the back of the store helps me to be more aware of my weekly spending limits plus it helps me avoid those impulse purchases when traveling the aisles in the store. You could also keep track of your grocery store runs and keep a log if you find your more often buying name brands over store brands - these thriftier options can really save you in the long run and often don’t taste any different.

4️⃣ Build flexibility into your monthly spending. Give yourself some grace if schedules need to adjust, or unplanned activities pop up and you need to go out compared to eating in. Being limber when it comes to your grocery spending is important because life happens and we cannot always plan out our days and weeks perfectly. I would also encourage you to reflect on if you can find are there particular days of the week that consistently derail your plans? I found that on Wednesday when I was going into the office, my day was typically longer than normal so I just scheduled in my meal plan that every Wednesday night was carry-out. It gave me such peace of mind, and my family enjoys figuring out ahead of time where we will eat compared to rushing through a random drive-thru close to home.

What Can A Healthy Food Budget Feels Like?

After you have massaged your new grocery spending plan over the course of 90-days I really hope you find that your changes are sustainable and peaceful - not restrictive. Being able to predict your monthly grocery expenses can be freeing because you are not anxious about how to cover this line item because you have been thoughtful in not only the scheduling of the weekly shopping trips, but you have compared your numbers against a trusted data source. My hope is that you will learn that having a healthy monthly grocery line item is comforting and perhaps guilt-free because you have thought out the entire purchase without impulses. If you are curious about some of the data from the website, take a look below.

Here is a quick USDA comparison chart.

Your 2026 Grocery Spending Starts With Awareness, Not Perfection

A simple awareness of your overall grocery expenses is a wonderful start. The goal is not to enforce strict rules but to get clarity to your numbers, build confidence in changing your spending if needed and start shopping with intention. Your grocery budget will evolve as your household changes. The goal isn’t perfection — it’s clarity, confidence, and intentional grocery spending. A simple reset today can shift your entire financial picture this year.

In closing, a perspective from Frank Sonnenbery: “Being frugal doesn’t mean slashing your spending or depriving yourself of things that you enjoy. It means knowing the value of a dollar and making every effort to spend it wisely.”

I hope this has been helpful to answer the question “How Much Should I Spend On Groceries” which allows you to define budgeting for food at home. If you would like help or support to further define your grocery spending habits, let’s chat. We can meet to strategize to move you from uncertainty to full financial power, it all begins when you schedule a FREE 45-minute clarity call.

If you have enjoyed this article, follow me on social media @lordfinancialcoaching.